This is the first step to be taken by a person who is liable to make payment for service tax so that one can discharge its service tax liability.

Who is Liable for service tax registration?

- Mandatory for a person providing taxable services and the value of services rendered by him is expected to be more than 9 lakhs in a financial year. However if the value of services rendered is less than 9 lakhs in a financial year then it is optional.

- Person made responsible to make payment of tax as per Rule 2(1)(d) of the service tax rules, 1994 under reverse charge.

- Input Service Distributor

- Person providing taxable services but claiming benefit of Notification no. 33/2012 dated 20.06.2012

Mode of Registration

Keeping in view the rapid technological changes and for the accomplishment of the vision of E-governance, Online registration has been made mandatory for all kinds of assessees with effect from 30.09.2009.

Steps for online registration-

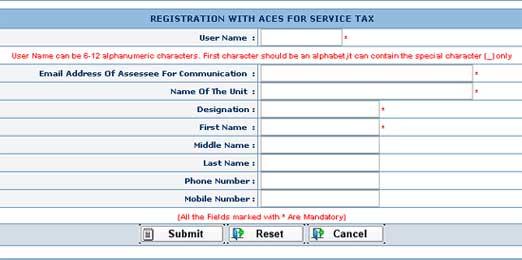

- Kindly go to aces.gov.in >> select Service tax>> Click on New Users to Click here to Register with ACES and an account will be created. After creation of account on the website, a password would be sent to your email id. You would be required to change the password and set a new custom password

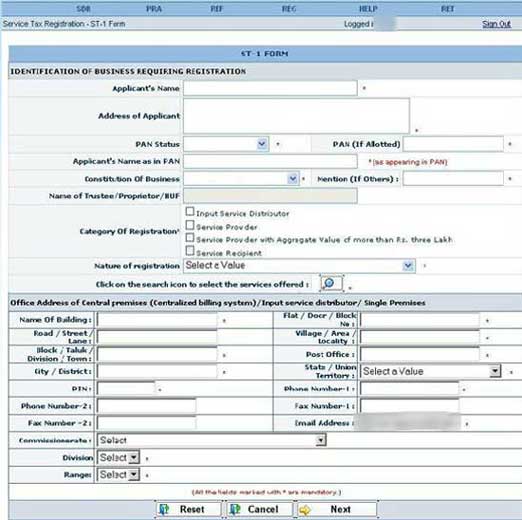

2. Now after logging into your newly created account on the website, Assessee has to file Form ST-1 available under the REG tab. On clicking on Fill ST-1 , a web utility of ST-1 Form will open and the Assessee has to provide the details as required by the form. One should carefully furnish all the details as required. To get the details of the Range, Commisionerate and Division you should visit Service Tax Office Locator.

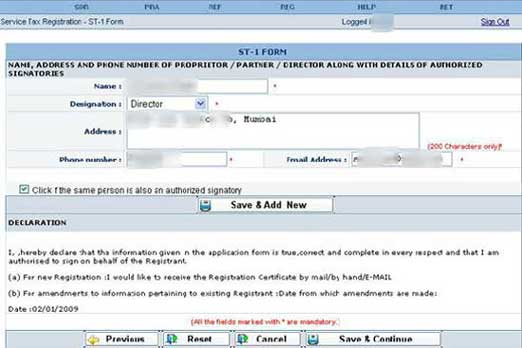

3. After this on the next page, you need to give details of proprietor/partner/director and authorized signatory. You can add one or more person to this section

After clicking on Save & Continue there will be a preview of all the submitted information in previous steps and accordingly you can modify the information, if required. After being satisfied that all the provided information is correct you can submit the form.

Documents required for Registration

You do not have to attach any documents. The ACES website itself checks the PAN authenticity. However some applicants may be asked to send signed physical copy of the documents to the superintendent of service tax alongwith the acknowledgement of online form submission. You may need to give copy of following documents.

- Copy of Permanent Account Number (PAN)

- Proof of Address

- Constitution of the applicant- Partnership deed, MOA & AOA

- Power of Attorney