Process & Documents Required for Online Service Tax Registration under Service Tax

Process of Registration Under Service Tax

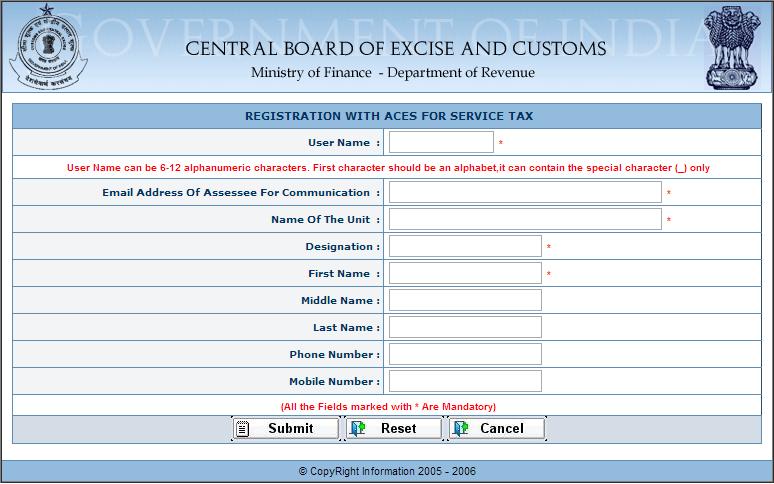

Fill the Form ST-1 through Service Tax Department Website. Note: A system generated password is mailed on the e-mail address as mentioned in the ACES Registration details which can be used for logging into the system.

List of Documents Required for Service Tax Registration:

- Printout of ST-1 Application filled online, signed by service provider or Authorised Signatory within 15 days of Online submission of service tax registration application

- Photocopy of PAN card

- Proof of residence / Address of the premises to be registered/copy of telephone bill. Electricity bill. Rent agreement in the name of the company or in the name of proprietor/ partner/firm in the case of proprietary or document accepted by any of Central/ State Government Department e.g. i.e. Income Tax. Sales Tax. Registrar of Companies DGFT or passport in the case of address.

- Constituent of the applicant for partnership firm: Copy of Partnership Deed and for Companies copy of Certificate of Incorporation, AOA and Memorandum of Association.

- Power of attorney in respect of authorized

- Copy of PAN card is necessary as a PAN based code (Service Tax Code) is allotted to every assessee. In case if an Assessee does not have PAN, can still register with a Temporary Registration Number

- Undertaking on Letter head of Assessee

- The jurisdictional Deputy Commissioner/Assistant Commissioner generates the Registration Certificate after viewing the particulars in the application. The registration certificate will be duly signed and sent to the Assessee in the mode as selected in the application. After Post verification is completed, the Registration Certificate can be viewed under the REG menu by the assessee. In the case of Service Tax, post verification is not mandatory and Registration Certificate will be generated after document verification.

- These documents are required to be submitted to the jurisdictional Central Excise office (in case of six Service Tax Commissionerates, to the jurisdictional Division office. There are separate service tax commissionerates in Mumbai, Chennai, Delhi, Kolkata, Bangalore and Ahmedabad as mentioned in the previous chapter).

Penalty for non registration : Failure to make an application for registration within stipulated period of 30 days attracts penalty of any amount upto Rs. 10000/-

How to submit online request for surrendering your Registration Certificate in ACES though:

REG-> Surrender RC (In case of CE)

REG->Surrender (In case of ST)

Once the surrender request is submitted by the Assessee, approval process passes through the Superintendent and then AC/DC