Tax Payer can apply or file their request for reissue of Income Tax Refund cheque for Year upto Assessment year 2013-2014. From AY 2014-15 Income tax refund will be directly credited to tax payers bank account as given in Income tax return but still their will be problems related to refund amount not credited to bank account given in ITR due wrong bank account number or wrong IFSC code which can be rectified through Income tax India website. Problem related to the reissue of Income Tax Refund arises only when the actual income tax refund cheque is not encashed. Few possible reasons for that could be:

- Wrong bank account no.

- Refund cheque returned due to non availability of address

- Income Tax Refund cheque expired after 3 months i.e. refund cheque expired

- Door Locked at the time of delivery

Actual Status of Income Tax Refund depends on Income tax department which confirms the final value of refund after processing the returns. This facility of correction in bank account number, change in address and reissue of refund cheque is applicable for ITR filled through online website of Income tax department.

Final Refund Status has three options

- Assessee gets the refund,

- No Refund and

- Outstanding Income Tax Demand.

If there is any refund, it will be sent to the Tax payer by either of the following ways:

- Through Cheque, or

- Through Electronic Clearance System directly to Bank Account

Therefore the Tax payer needs to give correct and accurate information such as his address, bank a/c number, PAN to the Income tax department.

Sometimes you see a message saying ‘Return cheque undelivered due to change in postal addresses’. This is a common problem wherein the tax payer would have changed the address, but missed to notify the income tax department. You can only raise a request of refund re-issue if your refund failed to reach you and was returned to the Income Tax Department.

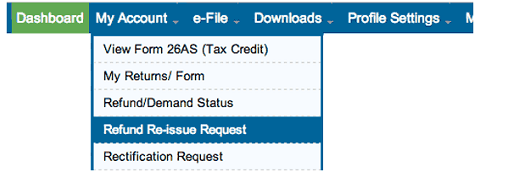

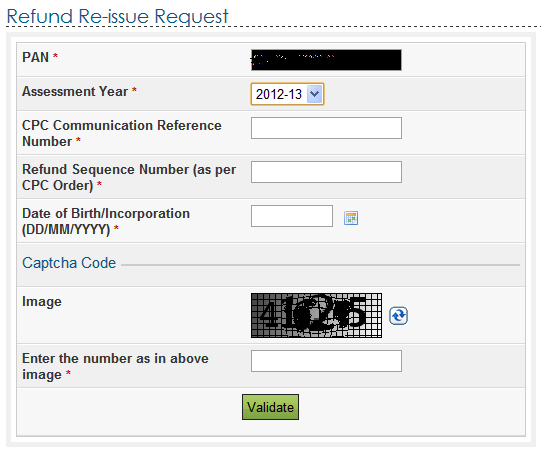

In that case, login in the Income Tax e-Filing website and go to ‘My Account’ → ‘Refund re-issue request’. Select the mode through which you wish to receive the refund- ECS or Cheque. Provide the new Bank Account Number (if to be changed) and provide the new Address. Submit the request. Once the request is submitted, your new Address is updated with the Income Tax Department.

If there is change in your bank a/c number then you can only change your Bank Account Number if you had a refund failure i.e. your IT Return is processed and a refund was generated for you but you did not receive it.

If you wish to change the Bank Account Number for Refund failure case, then login in the Income Tax e-Filing website and go to ‘My Account’ → ‘Refund re-issue request’. Select the mode through which you wish to receive the refund- ECS or Cheque. Enter the new Bank Account Number and provide address details. Submit the request. Once the request is submitted, your new Address is updated with the Income Tax Department.

Tax Payer needs to download the ‘response sheet’ from the Income tax website and take a printout of the same. Fill the necessary fields in it. Original cancelled cheque must be enclosed with it.

Few points to be noted while sending a Response sheet:

- Signature of the tax payer is mandatory

- Original Cancelled cheque must be enclosed, no photocopies

- A/c number or MICR code should on Response sheet be same as on cheque

- Signature on the Response Sheet and cancelled cheque should be same.

Response sheet is given below for your reference.

For any refund related query or modification in the refund records related to the Return processed at CPC Bangalore, the CPC may be contacted by the taxpayer on 18004252229 or 080-43456700.

My refund cheqe is non delavary my adress pan no.AADFL1***A plise refund credit to my bank a/c 3201020000 ifsc cod ibkL0000 idbi bank bharuch

You can file online request with reissue of Income Tax REFUND CHEQUE on new address

i want to know what is CPC communication reference no. and refund sequence no.

You can get your refund sequence no and CPC communication No only through income tax order under section 143(1) sent to you by email by Income tax department

We updted the refund reissue procedure by the income tax websit. But each time, it was getting failure. We are giving correct information but each time getting failure. We called cpc but no sufficient answer from them. How can we get refund?

ASK FOR INCOME TAX CHEQUE or DIRECT TRANSFER MIGHT HAVE ISSUE RELATED TO NAME AS PER PAN CARD AND NAME IN BANK ACCOUNT NUMBER

My pan no AHXPA9403B I got refund cheque for 2013-2014 but the cheque date 90 days is over then I gave the ch to I T dept Dindigul for revalidate the cheque but 1 SMS come to me please use online service. But don’t know how to use this service pl guide me

My tax refund cheque is not deliver of my address. My pan no AMFPR9692C

You can apply for reissue of Income tax refund cheque through through your income tax online account login id will be your PAN Number

REISSUE OF INCOME TAX REFUND

You can submit online request for reissue of Income Tax refund with options to change in address, change in bank account

my tax refund not issued me due to postman’s misunderstanding please reissue my income TAX REFUND

You can contact Income Tax Department helpline 1800 425 2229/ +91 8022546500 / 1800 103 4455

Second Option is request through your online account for reissue of income tax refund