Now Government has made it compulsory to link your Aadhaar with PAN and before doing linking PAN Card details should match with aadhaar card details and in case if there is any mismatch in PAN details and Aadhaar details person has to update any one of the details which he thinks is wrong and not matching with other.

Prime Minister Narendra Modi came to power in 2014 with promise to fight corruption and Central Government is taking every possible step to curb and control the corruption and in this process, government has mandated the linking of Aadhar with PAN for individual and process of linking Aadhaar to PAN number is very simple and can be done directly through the Income Tax India Website. Linking is compulsory for Individual as Aadhaar is issued to Individual only.

Also before updating, we can check the details available with Income Tax department using Name and Date of Birth and person can directly download the Aadhaar card from UIDIA Website. In case if individual finds mistake in both aadhar and PAN card details then first he should update the AADHAR card details online or by visiting any aadhaar help centre in their city and once aadhaar details are updated it will be very easy to update PAN details using aadhaar based e-verification process, please note that individual must update his or her mobile number in aadhaar card as every verification is OTP based and it won’t be possible to update PAN online without updating mobile number in aadhaar card. Individual can update aadhaar card details for free and government never charge any fees for updating aadhaar card and Rs.110/-(93+18% GST)

Income Tax Department has allowed the AADHAAR Card as proof of Identity, Address and Date of Birth and made it compulsory for all the new PAN applicant to give aadhaar number in new PAN application.

Following documents are required to be submitted along with the form:

- Proof of PAN (the one currently in use- mentioned at the top of the application);

- Proof of PAN(s) surrendered;

- Proof of identity;

- Proof of address;

- Proof in support of changes sought*, if any;

Supporting documents required for changes in PAN data can be as per the table is given below:

| Sl.No. | Applicant Type | Document Acceptable |

| 1 | Change in name: change of name on account of marriage | Any one of a) Marriage certificate b) marriage invitation card c) publication of name change in official gazette d) copy of passport showing husband’s name |

| 2 | Change in name: Individual applicants – change of name on account of reasons other than marriage. | Publication of name change in official gazette |

| 3 | Change in father’s name | Publication of name change in official gazette |

| 4 | Change in name: Companies | Registrar of Companies’ certificate for name change |

| 5 | Change in name: Partnership firms | Revised Partnership Deed |

| 6 | Change in name: AOP / Trust / BOI / AJP | Revised registration certificate / deed or agreement as applicable |

| 7 | Change in date of birth: individuals | Relevant proof of identity having correct date of birth. |

| 8 | Change in date of incorporation/agreement/partnership or trust deed/formation of BOI/AOP | Relevant proof of identity having correct date of incorporation/agreement/partnership or trust deed/formation of BOI/AOP |

A nominal fee of Rs. 105 (Rs. 93 + 12.36% service tax) will be charged for issuing a duplicate PAN card or for changes or correction in PAN card.

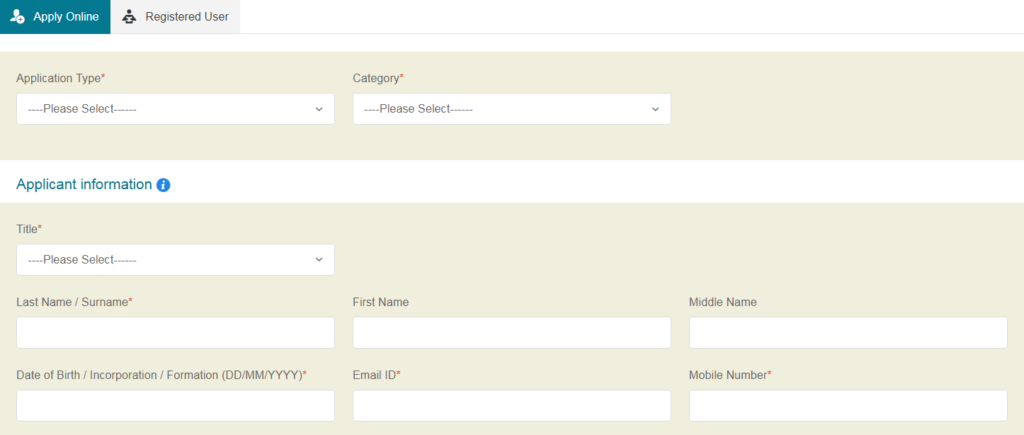

You can apply online for change or duplicate PAN card issue:

List of Document used as Identity Proof for PAN Card Issue or reissue:

- School leaving Certificate

- Matriculation Certificate (10th Class Passing Certificate (Not 10th Mark sheet),

- Degree from Recognized educational Institute

- Depository Account Statement

- Bank Account Statement

- Passport

- Water Bill

- Ration Card

- Voter’s ID card

- Driving License

- Credit Card

- Property Assessment Tax

- Certificate issued by gazette officer, MP, MLA or Municipal Councilor

Income Tax PAN Service Unit Managed by NSDL and Call Center Number

- Call TIN Call Centre at 020 – 27218080; Fax: 020 – 27218081

- e-mail us at: tininfo@nsdl.co.in

- SMS NSDLPAN Acknowledgement No. & send to 57575 to obtain application status.

- Write to: INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance Infrastructure Limited), 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016