As per Income Tax Act, 1961, every person who is collecting tax as per the provisions of 206C shall apply for a Tax collection account number to the Assessing officer. After the allotment of such number, the Assessee shall quote the number in all the Challan used for payment, all the return delivered, in all the certificates furnished under sec 206C, etc

If a person fails to comply with the provisions of Section 206CA, then he shall be liable to penalty of Ten thousand rupees under section 272BBB

TAN or Tax Deduction and Collection Account Number is a 10 digit alpha numeric number required to be obtained by all persons who are responsible for deducting or collecting tax. It is compulsory to quote TAN in TDS/TCS return (including any e-TDS/TCS return), any TDS/TCS payment challan and TDS/TCS certificates.

To Get Tax Collection Account Number one have to follow the following procedure:

- An application for allotment of TAN is to be filed in Form 49B and submitted at any of the TIN Facilitation Centers meant for receipt of e-TDS returns. form 49B is here.

- Addresses of the TIN Facilitation Centers is :

National Securities Depository Limited

Trade World, ‘A’ Wing, 4th floor

Kamala Mills Compound

Senapati Bapat Marg

Lower Parel

Mumbai – 400 013

Phone: 022-2499 4650 (hunting)

Fax: 022- 2495 0664

e-mail: tininfo@nsdl.co.

- No documents are required to be filed with the application for allotment of TAN. However, where the application is being made online, the acknowledgment which is generated after filling up the form will be required to be forwarded to NSDL.

- The applicants for TAN are to pay Rs.62/- (Inclusive of service tax as applicable) as processing fee at the TIN FC at the time of submitting Form 49B.

- NSDL will ensure intimation of new TAN at the address indicated in the Form 49B or against the acknowledgement in case of online applications for TAN.

- TAN once allotted can be used for all type of deductions. It can also be used in case tax is being deducted at source also.

- In case a TAN has already been allotted, no separate application needs to be made for obtaining TAN. The same number can be quoted in all returns, challans andcertificates for TCS. However, if no TAN has been allotted, a duly filled in Form 49B, along with the application fees is to be submitted at any TIN-FC.

The nature of goods covered under 206C is:

| Sl No | Nature of goods | % of TCS | |

| (i) | Alcoholic Liquor for human consumption | 1% | |

| (ii) | Tendu leaves | 5% | |

| (iii) | Timber obtained under a forest lease | 2.5% | |

| (iv) | Timber obtained by any mode other than under a forest lease | 2.5% | |

| (v) | Any other forest produce not being timber or tendu leaves | 2.5% | |

| (vi) | Scrap | 1% | |

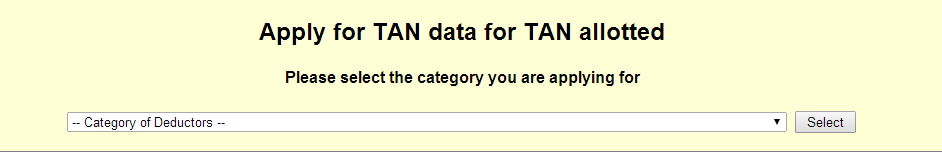

Persons authorised to make credit card / debit card / net banking payment for other categories are as below:

| Category of applicant | Authorized person whose credit card / debit card / net banking can be used for making the payment |

| Company/Branch/Division of a company | Any Director of the Company |

| Individual (Sole Proprietorship) / Branch of individual business | Self |

| Hindu Undivided Family (HUF) | Karta |

| Firm / Branch of firm | Any partner of the firm |

| Association of Persons/Body of Individuals/ Association of Persons (Trusts)/Artificial Juridical Person | Authorized signatory covered under section 140 of Income Tax Act, 1961 |