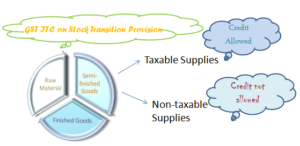

Transition provisions are incorporated under GST to enable existing tax payers to migrate to GST in a transparent and exact manner. One of the major concerns for businesses is the availability and eligibility for claiming input tax credit when the current indirect tax regime changes to GST.

Transition provisions are incorporated under GST to enable existing tax payers to migrate to GST in a transparent and exact manner. One of the major concerns for businesses is the availability and eligibility for claiming input tax credit when the current indirect tax regime changes to GST.

Transitional provisions under GST law address three key issues:

- Transition of credit of central taxes paid on goods in stock:

- A manufacturer having an existing registration can carry forward his CENVAT credit as CGST credit. He can entitle to take balance of CENVAT credit of capital goods.

- A dealer who had not registered earlier or a second stage dealer can take CENVAT credit paid on inputs,

- if he has invoice or any other document

- such as credit transfer document evidencing payment of central excise duty on the stock.

- A manufacturer can issue credit transfer document for goods having value of more than Rs. 25,000/- per item, bearing the brand name of the manufacturer, if he maintains verifiable inventory and supply chain records.

- A dealer who had not registered earlier, can take input tax credit of 60% of CGST paid

- where the CGST rate is 9% or more and

- 40% of CGST paid in other cases for the period of 6 months, on stocks

- which were not unconditionally exempted earlier but no CENVAT paying document is available.

- Transition of credit of state taxes paid on goods in stock:

- Credit in relation to stock received in inter-state sale is subject to submission of information regarding value.

- A dealer can claim balance input credit on VAT reflected in the return subject to submission of prescribed information. He can also take balance of VAT credit on capital goods.

- A dealer who had not registered earlier can claim credit of VAT paid

- on stock at hand on the basis of purchase invoice of goods in stock.

- Credit on goods in transit:

- Credit of both central and state taxes paid on goods in transit on the day of the transition i.e. 01-07-2017 is available on the basis of duty paying documents.

Transition of registration:

- Any dealer who has registered under state VAT, Central Excise, Service Tax, etc. having a valid PAN is eligible for provisional registration.

- Dealers who are eligible for provisional registration would eligible for final registration on submission of documents.

Transition without double taxation:

No tax is payable –

- on supply of goods and services

- under GST to the extent the taxpayer paid tax on such supply under the earlier law.

- on return of goods within six months

- where taxepayer paid taxes and goods removed prior to 01-07-2017.

- on return of goods from job-worker to the principal within six-months

- where the supplier sent goods for job work before 01-07-2017.

Other relevant transitions under GST Model:

Other relevant transitions under GST Model:

- Amount payable in the event of a taxable person switching over to composition scheme

- Case where exempted goods and duty paid goods returned to the place of business after GST implementation

- Inputs returned from Job Work after GST implementation

- Semi-finished goods returned from job work after GST implemetation

- Finished goods returned from job work after GST implementation

Duties and taxes eligible for claim for credit:

- CGST: Excise Duty, Additional Excise Duty, National Calamity Contingent Duty, Additional Custom Duty, Service Tax

- SGST: VAT, Entry Tax

Brief overview of Transitional Provisions under GST:

- Migration of existing taxpayers to GST

- Transfer of CENVAT Credit in electronic credit ledger

- Unavailed CENVAT Credit on capital goods not carried forward in a return

- Credit of eligible duties to be allowed in case

- a person was not liable to be registered under earlier law or was manufacturing exempted goods and to a taxable person switching over from composition scheme

- Disposal of Pending refund claims under earlier law

- Disposal of Claims of CENVAT Credit under earlier law

- Proceedings related to output duty liability