It has been long pending issue to streamline all the different types of indirect taxes and implement a single taxation system.

- The main expectation from this system is to abolish all indirect taxes and only GST will be levied.

- Thus, GST will replace all indirect taxes levied on goods and services by the Indian Central and State Governments.

Major chronological effects that have led to the introduction of GST:-

| Advantages of indirect taxes:- | And limitations of existing structure:- |

|

|

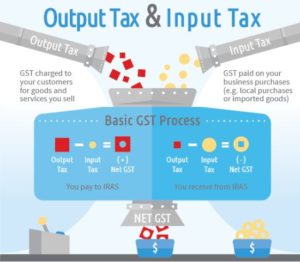

Applicability and mechanism of GST:-

Applicable GST rate:-

With GST, it is anticipated that the tax base will be comprehensive, as virtually all goods and services will be taxable, with minimum exemptions. |

Which taxes at the centre and state level are being subsumed into GST?

GST will be a game changing reform for the Indian economy by creating a common Indian market and reducing the cascading effect of tax on the cost of goods and services. It will impact the tax structure, tax incidence, tax computation, tax payment, compliance, credit utilization and reporting, leading to a complete overhaul of the current indirect tax system.

GST will be a game changing reform for the Indian economy by creating a common Indian market and reducing the cascading effect of tax on the cost of goods and services. It will impact the tax structure, tax incidence, tax computation, tax payment, compliance, credit utilization and reporting, leading to a complete overhaul of the current indirect tax system.

GST regime:-

Conclusion:-

- GST- Goods and service tax aim is to reduce the overall tax burden and associated administrative complexity. Industry is expecting that roll-out of GST will make supply chain decisions tax neutral.

- Under the proposed GST regime, all taxes will be bundled under two heads Central GST (CGST) and State GST (SGST).

- CGST will subsume all taxes imposed by Central Government and SGCT will subsume all taxes imposed by State Government.

- In proposed GST model State Government will also be able to impose tax on services.

- In the proposed framework CGST will be covering entire value chain upto retail level. This will help in widening the tax net.

- In the GST model for interstate sales integrated – GST (IGST) has been proposed which can be offset against the output liability. This will effectively reduce the CST rate to zero.